The 2023 OAG Punctuality League has just been published and analyses the full year of flight data from 2022 to reveal the On-Time Performance of the world’s largest airlines and airports.

The Punctuality League reveals on-time performance rankings for airlines, including the Top 20 airlines worldwide, the Top 20 Mega airlines, the Top 20 low-cost airlines, and the Top 10 airlines by region. On-time performance for airports includes rankings for the Top 20 airports worldwide, the Top 20 Mega airports, and the Top 10 airports by region.

Below is a quick summary of the report’s key findings.

To qualify for inclusion in OAG’s Punctuality League, OAG must have flight status data for at least 80% of all scheduled flights operated by the airline or airport.

OAG’s definition of on-time performance (OTP) is flights that arrive or depart within 15 minutes of their scheduled arrival or departure times.

Cancellations are included within the OTP calculations and are counted as late flights.

Airlines

- Airlines ranked in the 250 largest global airlines – by annual Available Seat Kilometres

- (ASKs) – are analyzed for inclusion in the report.

- Airline OTP calculations are based on operating carrier code and are restricted to scheduled passenger flights only.

- Airline OTP is calculated based on arrivals data only.

- Flights where OAG do not have the required arrival time or confirmation that the flight was diverted or cancelled are not included in the OTP calculations for airlines.

- All scheduled flights operated by affiliate carriers on behalf of another carrier are included in the analysis.

Airports

- Airports must have a minimum of 2.5m departing seats to be included in the report.

- Airport OTP calculations are restricted to scheduled passenger flights only.

- Airport OTP is calculated based on both departures and arrivals data.

- Flights where OAG do not have the required departure and arrival time or confirmation that the flight was diverted or cancelled are not included in the OTP calculations for airports.

Airlines

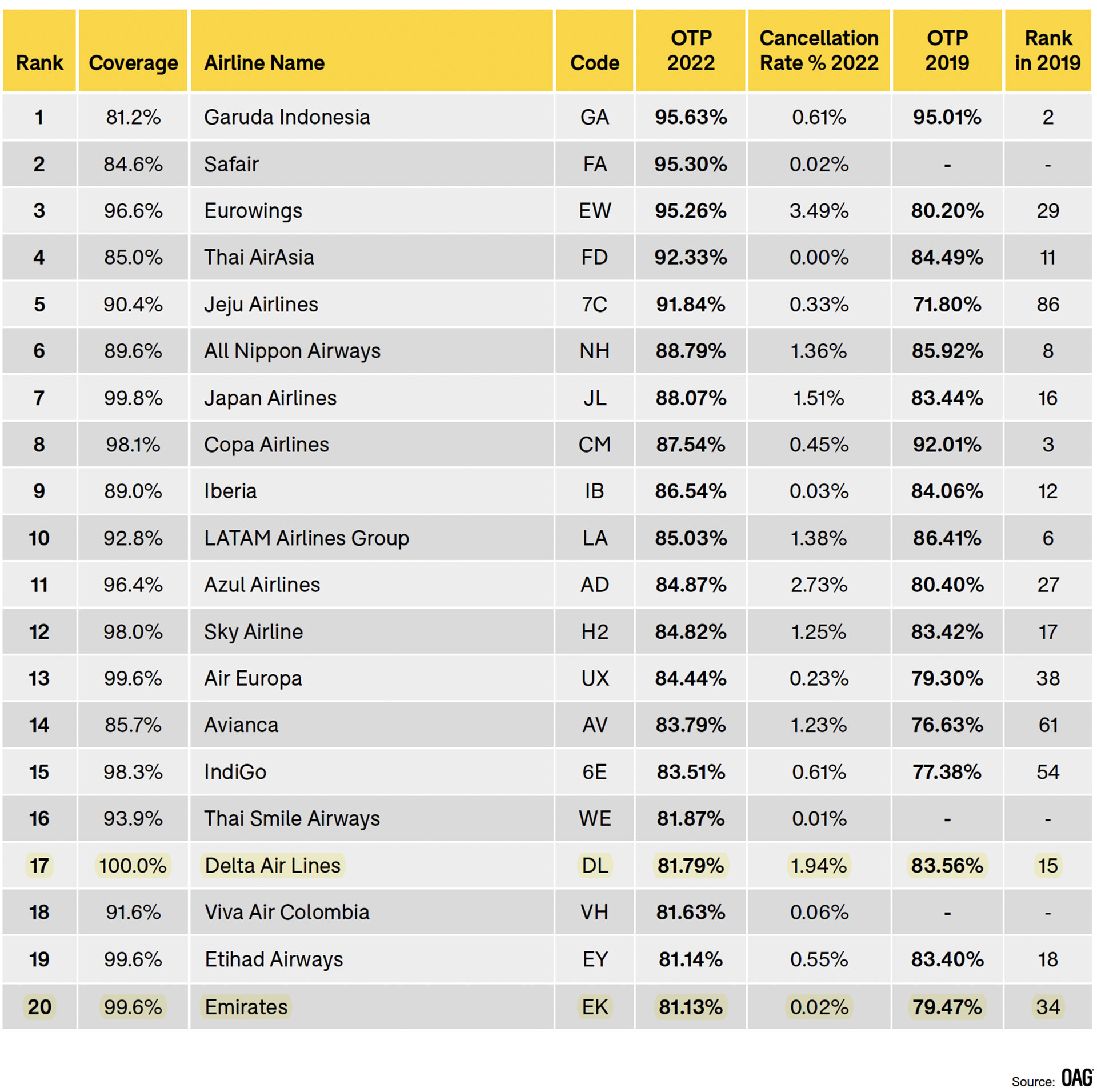

Japan’s biggest airlines see a return to the top of the table as the most punctual Mega airlines (defined as Top 20 largest airlines in the world by frequency); All Nippon Airways (NH) is in first place with an OTP of 88.79% and Japan Airlines (JL) is in second place with an OTP of 88.07%.

They are closely followed by two of the largest South American carriers, the LATAM Airlines Group (LA) and Azul Airlines (AD) who both have seen OTP of 85.03% and 84.87% respectively in 2022.

Scandinavian Airlines (SAS) and Air China (CCA) drop below the Top 20, replaced by Azul Airlines (AD) and Spirit Airlines (NK). Indigo (6E) has moved up the rankings, from tenth in 2019 to fifth in 2022. India’s biggest carrier has seen frequency increase over this period, now operating 8% more flights than in 2019.

Seven US carriers make it into the mega airlines category – by virtue of the US domestic market being almost back at 2019 levels – with Delta Air Lines (DL) the highest of the US carriers in sixth position globally in this group.

The US carrier OTP ranges from Delta Air Lines (DL) with 81.79% to JetBlue Airways Corporation (B6) with 63.90%, reflecting the challenging operating environment across airports this summer. Average OTP for this group is down to 73.36% compared to 77.85% in 2019. The average cancellation rate for this group is 4.24%, but this rate falls to 2.34% if we exclude China Eastern who have had an exceptionally high rate with ongoing lockdowns in Shanghai.

British Airways only came 17th among Mega airlines (defined as Top 20 largest airlines in the world by frequency). BA achieved a disappointing On-Time Performance (OTP) of only 64%, down 12% from 2019 and still managed to cancel a massive 2.79%. Of course, this wasn’t helped by Heathrow’s capacity cap during the year.

Airports

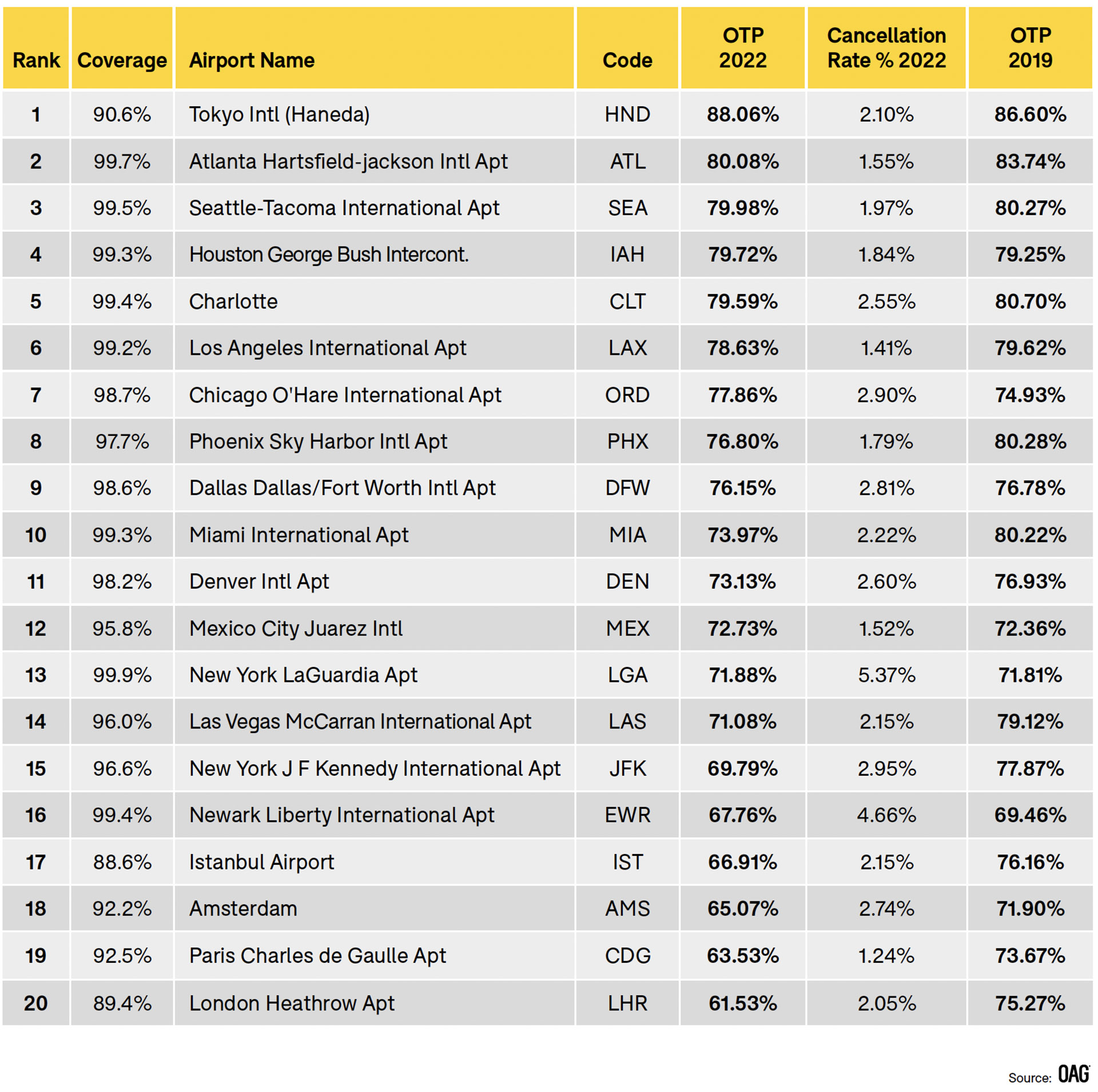

Tokyo Haneda (HND) has the highest OTP of the 20 largest airports in the world (measured by number of flights operated in 2022), with 88.06% of flights arriving on time. There is then a considerable gap between the next highest, Atlanta Hartsfield-Jackson (ATL), with an OTP of 80.08% in 2022.

14 of the Top 20 largest airports are in the US, reflecting the almost recovered nature of the US domestic market. OTP at the US airports in this group ranges from Atlanta Hartsfield-Jackson (ATL) at 80.08% to Newark Liberty (EWR) at 67.76%.

Newark also has the highest rate of cancellations in 2022, with 4.66% of flights being cancelled, reflecting the difficult summer many airports across the world have faced this year as the industry struggles to find enough people to staff airports and airlines.

OTP at Europe’s biggest airports is considerably lower this year than in 2019, again down to the operational resourcing issues faced in summer 2022. Amsterdam (AMS) has seen OTP decline by nearly seven percentage points on 2019, whilst Paris Charles de Gaulle (CDG) is down by ten points, and London Heathrow (LHR) by nearly 14 percentage points.

Related Articles

Getting the Most from Procurement Portals When Selecting Your TMC

Procurement portals are now a common way to run Travel Management Company RFPs, offering structure and consistency for procurement teams. But when portals are poorly configured, they can unintentionally limit supplier responses, create unnecessary friction, and make it harder to assess what truly differentiates one TMC from another.

Based on extensive experience responding to portal-based RFPs, this guide from Gray Dawes Travel shares nine practical ways travel managers and procurement leads can attract higher-quality responses, improve evaluation, and achieve better outcomes from the process.

Work Stays Made Easy

As winter fades and brighter days arrive, it’s the perfect time to plan ahead for a successful season of business travel. With over 800 Premier Inn hotels across the UK, you’re always close to your next meeting, conference, or event. From city centres to business hubs, enjoy convenient locations, comfy beds, blackout curtains for great sleep, and the option to upgrade to Premier Plus for extra comfort. Start your day with an unlimited breakfast, wind down with delicious on-site dining, and save with meal deals. Book early for the best value, flexibility, and stress-free stays wherever work takes you.

What to Do if Your TMC is Acquired

When your travel management company is acquired, the impact goes far beyond industry headlines. From technology changes and service disruptions to pricing uncertainty and contract implications, a merger can fundamentally reshape your corporate travel programme. This guide helps travel managers understand what’s really changing, the critical questions to ask their TMC, and how to assess whether staying or exploring alternatives makes the most strategic sense. With a clear framework for evaluating technology, service, costs, and stakeholder needs, you’ll be better equipped to protect programme value and move forward with confidence.